A fund factsheet is a document that summarises information about an investment fund, such as those held in a pension, so that you can decide whether the fund might be right for you. It usually includes details such as investment objectives, risks, historical performance, and a breakdown of investments by sector and geographic region.

Fund fact sheets don’t share a common template, so they don’t all look the same. But they do include similar information. So if you understand how to read one, you should be able to read any other.

To help paint a clear picture of what a fund factsheet looks like, we’ll use one of PensionBee’s own pension funds as an example. Here you can view one of the full Global Leaders Plan factsheets (managed by BlackRock), and we’ll display sections of it below as we guide you along.

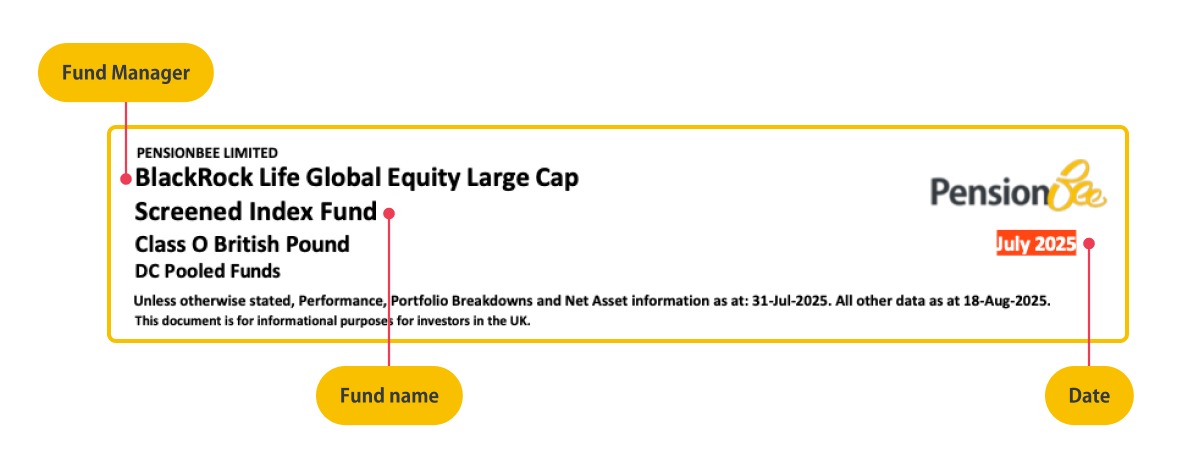

Fund name and date

The fund name should be clearly displayed at the top of the factsheet. Note that this may not always match the name of the fund advertised. For example, the name in this example is different from the name we advertise: Global Leaders Plan. We do this to simplify our offering.

The fund manager’s name should also be clearly visible. In this example, BlackRock - one of the world’s largest money managers - is shown to manage the fund. They will buy, manage and sell investments, and report back to investors in the fund.

The date will indicate the last time the factsheet was updated. Because these documents represent ‘snapshots’ in time, they may not reflect the current investments or performance of the fund. We update our factsheets every few months.

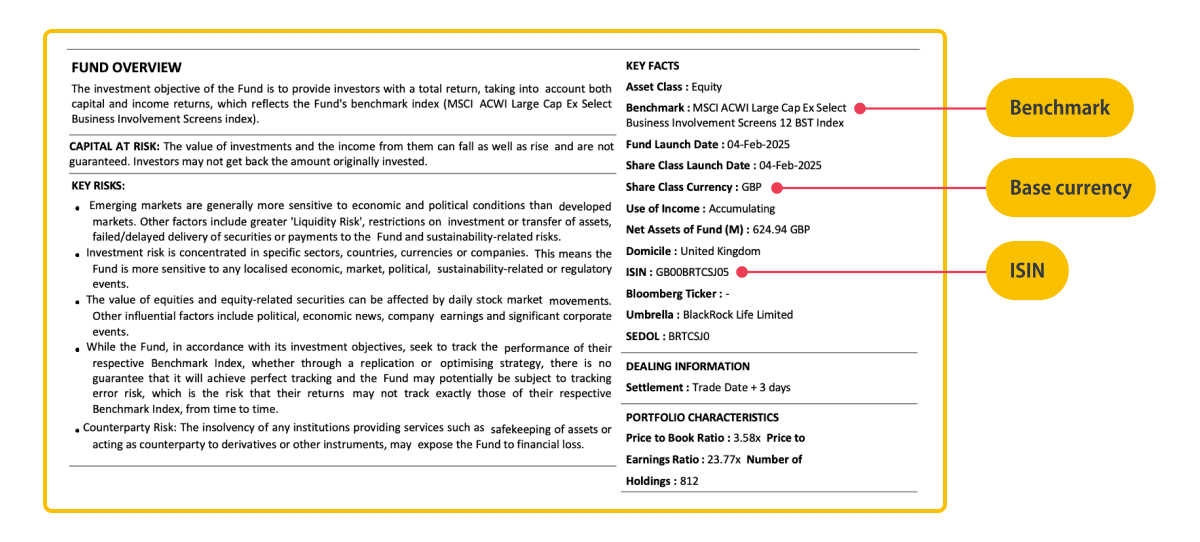

Key facts about the fund

The base currency is the currency the fund uses to buy and sell investments. This could be an important consideration if you invest money in the fund using a different currency, as you’ll have to factor in fluctuating exchange rates.

The benchmark shows the name of another fund or stock market index (such as the FTSE 100 or NASDAQ) that this fund’s performance will be measured against. This is important because it provides some context around whether this fund is performing well compared to other similar funds (shown elsewhere on the factsheet).

The ISIN (International Securities Identification Number) is a unique series of numbers and letters that can be used to identify the fund. This is useful because, as we’ve already seen, the fund may be called different names in different places. The ISIN, however, will remain the same. Note: not all funds will have an ISIN.

Other key facts about the fund should be listed near the top. These might include: the type of assets the fund invests in e.g. equities, bonds etc, key dates (such as when the fund was first launched), and the Net assets of the fund (M) - meaning the fund’s total assets minus its liabilities.

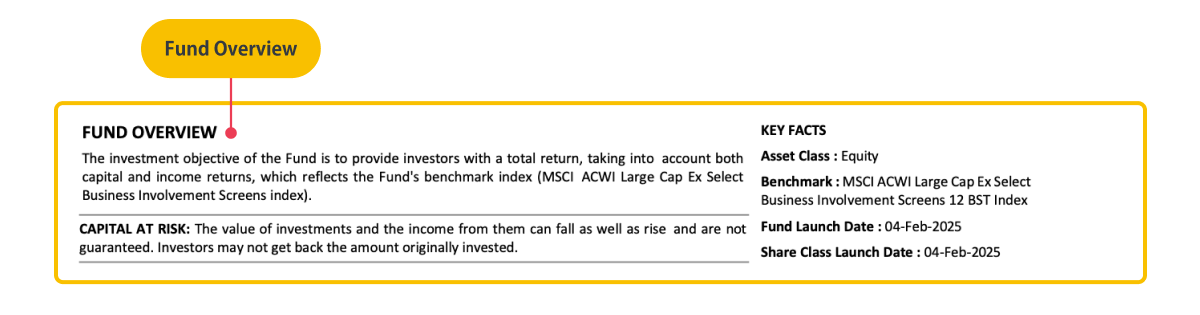

Investment objectives

The investment objectives (sometimes called the ‘investment goal’ or ‘fund aim’ or ‘fund overview’) outline the purpose of the fund. Think of it as a high-level summary to give a quick overview of who the fund might be suitable for.

Each fund manager will present this section differently, but they’ll often describe the type of returns they aim to make, the type of investments they plan to make, and the level of risk associated with their investment strategy.

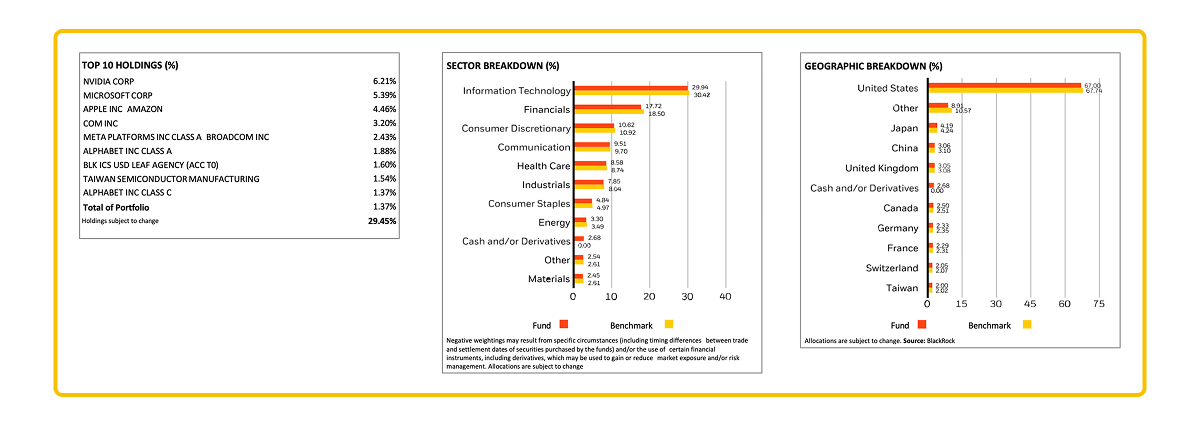

Investment holdings

Regional and sector breakdowns may also be displayed to highlight where the investments are being made. This can be helpful if you wish to focus or limit your exposure to certain markets.

The top holdings may also be shown if the fund contains a portfolio of assets. Usually, the top 10 investments are listed along with their percentage of the fund’s total holdings.

Historical fund performance

Historical fund performance is usually displayed in charts and/or tables. They’ll show historical fund returns by quarter or year, and should compare this against the fund’s benchmark (explained earlier).

Previous performance doesn’t have any impact on future performance, however. So this information shouldn’t be used to assess how much the fund might return in future.

The purpose of this section, really, is to see whether the fund has performed broadly in line with its benchmark. If it has, then it suggests that the fund may be adequately balanced for your needs.

Fees and charges

Often, fees and charges will be shown on the fund factsheet too.

Note: PensionBee only charges one fee, displayed in your online account known as your ‘BeeHive’, and therefore may not be shown on the fund factsheet.

Because some funds charge a variety of fees, it could be hard to determine exactly how much investing in the fund will cost you. And this is important because fees eat away at your investments over time, whether the fund has a good year or a bad one.

While different providers will charge different fees, at PensionBee, we charge just one fair annual fee to keep your costs simple and transparent. We display this clearly in your BeeHive.

Depending on your PensionBee pension plan, the fee may or may not be shown in the factsheet. If it is, you might notice the fee illustrated in the factsheet is less than the one shown in your BeeHive. This is because we split our fee with the money manager who manages the underlying fund. So the fee shown on the factsheet is the amount the money manager receives, and not the amount you pay PensionBee.

If you’re looking to combine your old pensions into one easy-to-manage online plan, sign up to PensionBee today.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Last edited: 07-11-2025