PensionBee, a leading online pension provider, has found that the gender pension gap among its Invested Customers (1) is least pronounced for those who self-identify as ‘self-employed’. Overall, self-employed customers have a gender pension gap of 3 while employed customers have a gap of 3.

While the gap narrows for all savers aged under , it becomes more pronounced among those aged and over at retirement. For those in this age group who self-identify as ‘employed’, the gap widens significantly to 5, compared to 37% for self-employed savers of the same age.

Additionally, PensionBee’s analysis found that the average overall pension pot size of the self-employed is 6% higher than that of employed customers, with the self-employed having an average pot size of £23,600 compared to £22,300 for employed customers.

The self-employed currently make up _basic_rate of PensionBee’s Invested Customers, and 3 of this group are female – a figure almost three times that of ONS findings which show that 11% of female workers are self-employed nationally (2).

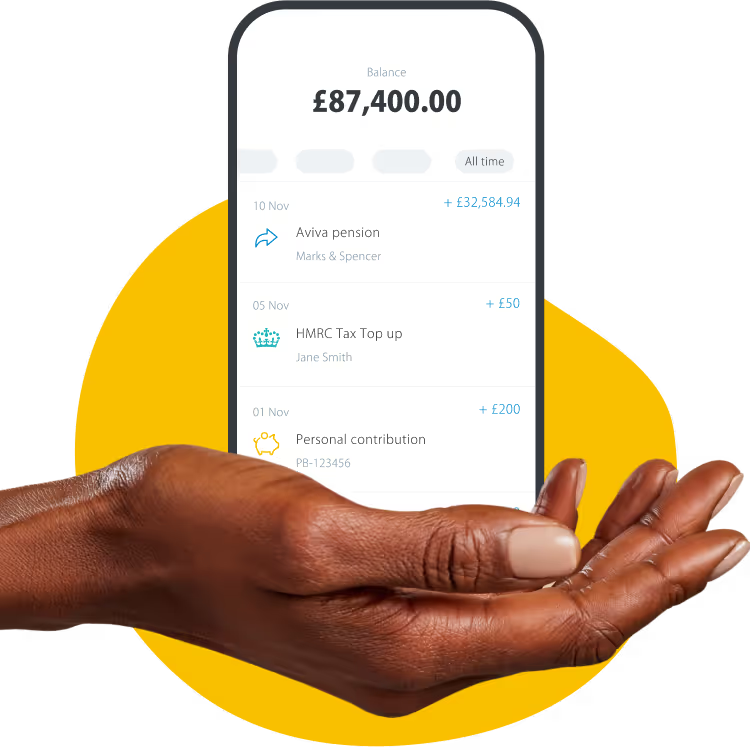

Earlier this year, PensionBee launched a flexible pension for the self-employed, which was specially designed for sole traders and directors of limited companies who do not have existing workplace or private pensions to consolidate. This allows the self-employed to start a new pension even if they’ve never saved before and, with no minimum contribution amounts, they can pay into their pension whenever their income allows.

Since its January launch, hundreds of savers have signed up to PensionBee’s self-employed pension, with almost _higher_rate of this group identifying as female.

Romi Savova, Chief Executive of PensionBee, commented: “It’s disappointing to see that, on average, women across the UK have less in their pension pots than their male counterparts. Everyone deserves to look forward to a happy retirement regardless of their gender, and more must be done to tackle this issue. However, it is encouraging to see the self-employed, a group that has been long underserved by the pensions industry and overlooked by Auto-Enrolment, making progress in closing the gender pension gap. To avoid a shortfall in later life more must be done to level the playing field, and female savers must be encouraged to make additional contributions to their pension on a regular basis, starting now.”

Appendix

PensionBee Customers are asked to declare their employment status when they first make a contribution to their pension. This analysis focuses only on Invested Customers who have declared their employment status.

Table 1: Gender pension gap

Source: PensionBee, February 2021. Based on 44,621 records of Invested Customers who have declared their employment status.

Table 2: Average pension pot size (£) by employment status

Source: PensionBee, February 2021. Based on 44,621 records of Invested Customers who have declared their employment status.

Table 3: Employment status of PensionBee’s customers

Source: PensionBee, February 2021. Based on 44,621 records of Invested Customers who have declared their employment status. “Other” refers to customers who are in full-time education, caring, retired and unemployed.

Table 4: Gender split of self-employed customers

Source: PensionBee, February 2021. Based on 8,858 records of Invested Customers who have declared that they are self-employed.

Table 5: Gender split of customers using PensionBee’s self-employed pension

Source: PensionBee, February 2021. Based on the 4 customers who are using PensionBee’s self-employed pension.

Footnotes

- Invested Customers (IC) means those customers with an account that holds pension assets in PensionBee plans.

- ONS