Skip navigation

You’re on the United Kingdom website. Switch to the US website here.

United Kingdom

Download our app or sign up online.

We’ll need your legal name, address, date of birth and National Insurance (NI) number.

Transfer your old pensions or start fresh with a contribution. Self-employed? Set up flexible contributions with no minimums.

Your personal account manager (known as your 'BeeKeeper') will guide you every step of the way. We’ll handle transfers (which typically take 12 weeks) and get your permission if needed. You can contribute by Easy bank transfer anytime in just a few clicks.

Update your personal details, select your beneficiaries, switch plans and contact your BeeKeeper online all from one place.

Make flexible personal contributions or ask your employer to pay directly into your PensionBee pension. Work for yourself? If you’re the director of a limited company, you can make employer contributions too.

View your live balance and check the performance of your pension as soon as your pensions are transferred or you make a new contribution.

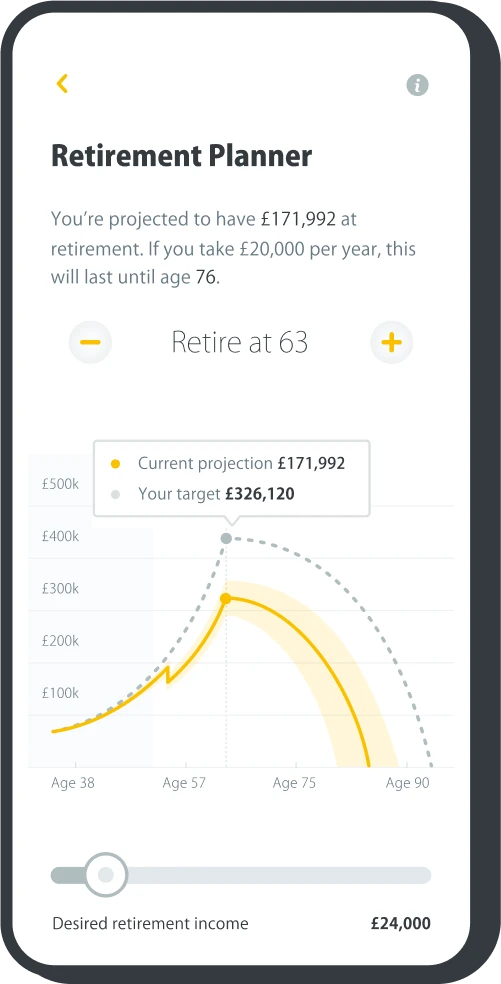

Get access to planning tools, checklists and your Retirement Planner, where you can track your progress and see how long your pension could last.

Once you reach 55 (57 from 2028) you can make one-off, or automatic monthly pension withdrawals from any of our plans online, through pension drawdown, no forms needed. One-off payments typically take 7-10 working days. Or, you can choose to receive a regular income and buy a pension annuity through our partner, Legal & General.

One simple annual fee is deducted from your pension automatically each month. You'll pay between 0.50% and 0.95% (depending on your plan) which includes the cost of your investments. Plus, we'll halve the fee on the portion of your savings over £100,000.

Our pension funds are managed by some of the largest and most experienced money managers in the world, including State Street, BlackRock, and HSBC.

We protect your data with the strongest, most up-to-date technology and processes. All of your information is encrypted using 128-bit Transport Layer Security (TLS) and our security is tested annually by independent experts.

We'll never share your personal information with anyone without your permission. Our systems and processes are set up to adhere to the UK General Data Protection Regulation (UK GDPR) requirements.

We meticulously vet the identity of all employees and customers to reduce the risk of identity fraud, or any other unauthorised access to your information or account.

Our information security practices are certified to the internationally recognised ISO 27001 standard as well as the UK Government's Cyber Essentials Plus Scheme.

PensionBee has been registered as a data controller with the Information Commissioner's Office since 2015. Our registration number is ZA131262 and you can view the entry on the ICO's website.

What does PensionBee do?

We’re on a mission to build pension confidence and put savers in the UK and the US in control of their retirement savings. Through our award-winning app, we make accessing your pension straightforward. It’s easy-to-use and allows you to withdraw with ease from age 55 (rising to 57 in 2028).

In the UK, PensionBee combines your old workplace pensions and transfers them into one new online pension plan, managed by some of the world’s largest money managers. If you don’t know exactly where your old pensions are, you can contact your former employer or use the government’s free Pension Tracing Service. Or, if you’re self-employed, you can set up flexible pension contributions as a sole trader or director of a limited company. Contribute as much or as little as you like, as often as you like.

The 'BeeHive' is a customer’s online account. Inside the 'BeeHive' you can contribute to your pension. Our app makes accessing your pension straightforward. It’s simple-to-use and allows you to withdraw with ease from age 55 (rising to 57 in 2028). You’ll be able to view your live pension balance and see your projected retirement income.

We have calculators and retirement forecasting tools to help our customers plan ahead, enabling them to build a clearer picture about what they should be contributing.

Why should I consolidate my pensions with PensionBee?

If you’ve had several different jobs then you probably have different pension pots scattered around. Most pension providers send a lot of paperwork that can be difficult to understand and contains hidden fees that can reduce the value of your pension. This makes it pretty difficult to keep track of your retirement savings and plan for the future.

PensionBee exists to make managing your pension easier. If you combine your pensions with PensionBee, and we discover that an old pension provider charges an exit fee of more than £10, or that your pension comes with special benefits or guarantees, we’ll ask your permission before we complete the transfer.

With PensionBee, you can access your pension easily through our award-winning app, meaning your pension is at your fingertips. You can see your current pot size, your projected retirement income, and set up regular or one-off contributions. Your dedicated account manager (known as your 'BeeKeeper') will be on hand to help you with anything you need.

Our user-friendly Pension Calculator can tell you whether you’re on track to meet your retirement goal. Remember, consolidating your pensions isn’t for everyone. Watch our video ‘Should I consolidate my pensions?‘ on YouTube to discover the pros and cons of consolidation.

Is it ever better to leave my pensions where they are? What if there are exit fees or guaranteed benefits?

Some older pension types may contain valuable special benefits or exit fees. It’s important that our customers are informed of significant exit fees that may have to be paid or special benefits that may be lost before transferring a pension. PensionBee doesn’t provide financial advice and you’ll need to find an Independent Financial Adviser (IFA) yourself. If you’re advised against transferring to PensionBee in this scenario, we won’t accept your transfer.

First, some background on special benefits and exit fees:

Special benefits (or “safeguarded benefits”) can refer to a variety of different features, such as:

- Defined Benefits (sometimes known as final salary);

- Guaranteed Annuity Rates;

- Guaranteed Minimum Pensions; and

- Life Cover.

The most valuable of these include a guaranteed element of future pension income. You’re required to obtain advice prior to transferring pensions with safeguarded benefits that have a total value over £30,000.

Exit fees can reduce the value of your pension. If we find a provider that has an exit fee of more than £10 we’ll always seek our customers’ permission to proceed with the transfer before taking action. It’s important to note that, unfortunately, we can’t guarantee we’ll find an exit fee or special benefits as we rely on clear information from third parties. If the exit fee is below £10 we’ll proceed with the transfer.

Do I have to transfer all of my pensions to PensionBee?

No, you only need to transfer one of your inactive pensions to PensionBee to get started. If your pension’s still receiving contributions, you can add it to your online account (known as your 'BeeHive') and when payments stop you can transfer the pension over.

You can add as many pensions as you like, at any time in the future. And if you’re self-employed, you don’t need to transfer any pensions at all. Instead, you can start a new pension with us and contribute flexibly as much or as little as you like, as often as you like.

Do I have to provide any ID to open a PensionBee account?

Many pension providers, including PensionBee, use online processes to verify your identity. We don’t usually require customers to provide ID, however if this is needed you can send it to us digitally. There are some providers who might require a certified copy of your ID, or name change document like a marriage certificate or deed poll.

In some cases, providers might ask you to send an original document in the post but we’ll encourage them to accept a certified copy instead, to try to save you the hassle and to speed up the process. You can read our Acceptable Proof of Identification policy to learn more.

How much does it cost to use PensionBee?

We don’t charge you any fees to transfer your pensions to PensionBee. There’s just one single annual fee, which is calculated based on the daily value of your PensionBee plan. For pensions under £100,000 you’ll pay one annual fee of 0.50 - 0.95%, depending on which plan you choose. If your pot size is larger than £100,000 we’ll halve the fee on the portion of your savings over this amount.

| Pension pot size | < £100k |

| Global Leaders Plan | 0.70% |

| 4Plus Plan | 0.85% |

| Climate Plan | 0.75% |

| Tracker Plan | 0.50% |

| Shariah Plan | 0.95% |

| Pre-Annuity Plan | 0.70% |

| Preserve Plan | 0.50% |

You can find more information on our Fees page.

Does PensionBee have an app?

Yes, we do! Our mobile app’s available in the App Store and Google Play stores, and you can use it to sign up, manage your pension and access your real-time pension balance with PensionBee - without needing to log into your online account (known as your 'BeeHive') through a web browser.

How do I get started?

Simply download the PensionBee app or sign up online with some basic details, including your National Insurance (NI) number. If you’re unable to locate it, you can easily find your NI number online using HMRC’s free tool.

Joining us is free and we’ll only start charging you one simple annual fee once we begin managing your pension.

You can pick from our diverse range of curated pension plans or we’ll automatically invest you in one of our two default options depending on your age. Our Global Leaders Plan is our default for those under 50 with our 4Plus Plan the default option for those 50 or over. You can change your plan at any time by going to the ‘Account’ section of your 'BeeHive'.

What if I don’t have an email address?

In order to set up a PensionBee account, you need to have your own email address which you have full control over. We’re a fully digital platform. We use two-factor authentication (2FA), also known as two-step authentication, which requires a mobile number and it’s a feature we’ve built into your PensionBee account.