Analysis by a leading online pension provider, Pensionee, has found that adding a redundancy payment to a pension can result in a gain of almost 5_personal_allowance_rate on the initial contribution for a typical worker (see table 1).

Due to the increased cost of living and a slowdown in the UK economy, 3_personal_allowance_rate of employers are likely to make staff redundancies over the next year.(1)

While job loss can be devastating, for those who are able to find new work relatively quickly, and have a redundancy pay check in hand, this extra cash can prove a useful way of boosting a pension pot.

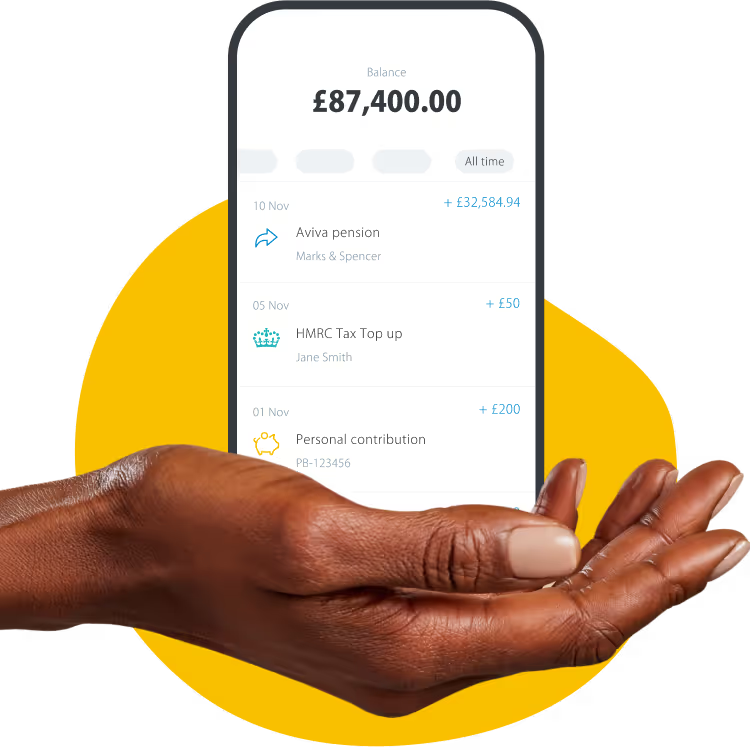

PensionBee has found that your pension can help you make the most of this otherwise potentially challenging financial situation and help boost your financial future.

Its analysis shows that a _money_purchase_annual_allowance redundancy payment to a pension at the age of 50, could increase the average pot by £14,_state_pension_age9 by age _pension_age_from_, to £257,894. If someone adds _isa_allowance at age 50, by _pension_age_from_ their pension pot would be worth £272,562 - £29,337 more.

Table 1: Impact of adding a redundancy payment to your pension

Source: PensionBee, October 2023. Assumptions: £_years_before_5,000 pot size by age 50, 1% salary growth a year, investment growth (after inflation), 0.7% fee, overall contributions.

About redundancy payments:

- The first £30,000 of a statutory redundancy payment is tax-free;

- after two years of employment, employers are required to pay at least statutory redundancy (one week’s pay per year of service), although often they pay more as part of a compensation package;

- many employers will pay some or all of a redundancy payment into a pension instead if requested;

- paying a redundancy payment into your pension can help you avoid going into a higher tax bracket as well as boosting your retirement savings (see tips, below).

Becky O’Connor, Director of Public Affairs at PensionBee, commented: “While you might need to use redundancy money to tide you over until you find more work, or to retirement, depending on your age, if you’re lucky enough to get another job quite quickly, this cash is tantamount to a windfall.

One of the most tax-efficient and generally financially beneficial things you can do with it is add it to your pension. If you are approaching , the age at which you can first access your pension, this can make even more sense, as you’re very close to being able to use that money again, but with the benefit of tax relief and hopefully some investment growth on top, too.”

Tips for what to do with your pension if you lose your job

- Firstly, don’t panic. When you lose your job your workplace pension still belongs to you. While your old employer will stop paying into it, your pension will still be managed by your pension provider and should continue to grow over the long term.

- It’s important to remember that workplace pensions aren’t the only option available to you, you can save into a private pension even if you’re not in employment. It’s worth considering combining your old workplace pensions together into one pension plan, where it makes sense to, to give you a holistic view of your savings and help you assess if you’re on track for your desired retirement.

- Accessing your savings when you have a defined benefit pension is slightly different. Before you can transfer it to a new provider, your previous provider will usually give your pension a cash value. Once the value has been received, it’s guaranteed for three months which acts as a deadline to transfer your money across. It’s important to note that if the transfer value exceeds £30,000, then you’ll need to take independent financial advice. In most cases, it’s better to leave your defined benefit pension with its current provider as you may lose any valuable benefits attached to it upon transfer.

- When applying for new jobs, you should consider the prospective employers’ workplace pension scheme. Defined contribution schemes offer a minimum total contribution, including the employee’s, of under Auto-Enrolment, but can be far higher. The amount employers pay in can vary from the minimum requirement of to well into double figures, which can make thousands of pounds difference to you when you retire. ‘Double matching’, when you increase what you put in and the employer doubles up on your contributions, up to a maximum, is a very effective way of ramping up the amount going into your pension.

- Work out how much of your redundancy payout attracts tax relief before deciding how much to contribute. Only the part of the redundancy payment over the tax-exempt threshold of £30,000 counts as relevant UK earnings and can therefore attract tax relief, as well as the part of the payment that comes from salary, bonuses or holiday. This is in addition to other UK relevant earnings, so can add up.

Footnotes