This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in April 2023?

It’s been a busy time in the UK this May, with: the King’s Coronation, the Premier League’s end-of-season games, and another interest rate increase from the Bank of England. The Bank Rate was raised to 4.5%, up from April’s 4.25%, as a response to the surprise rise in inflation that was seen in the 12 months preceding. The good news is that inflation was at 8.7% in May, a drop from April’s figure of 10.1%.

Keep reading to find out how markets have performed this month and how the rise in Artificial Intelligence may impact you as an investor.

What happened to stock markets?

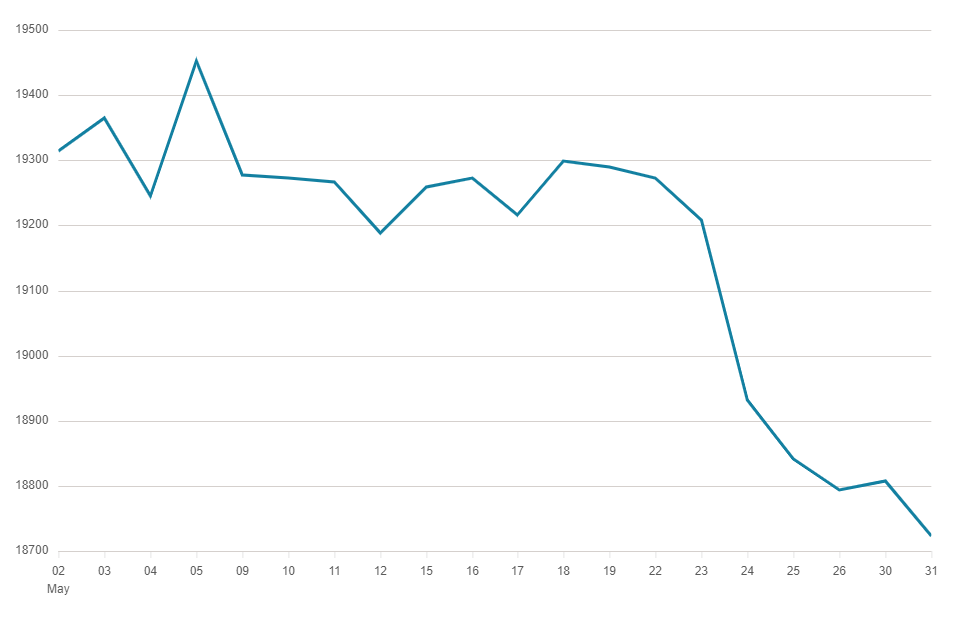

In UK stock markets, the FTSE 250 Index fell by almost 4% in May, bringing the year-to-date performance close to -1%.

Source: BBC Market Data

Source: BBC Market Data

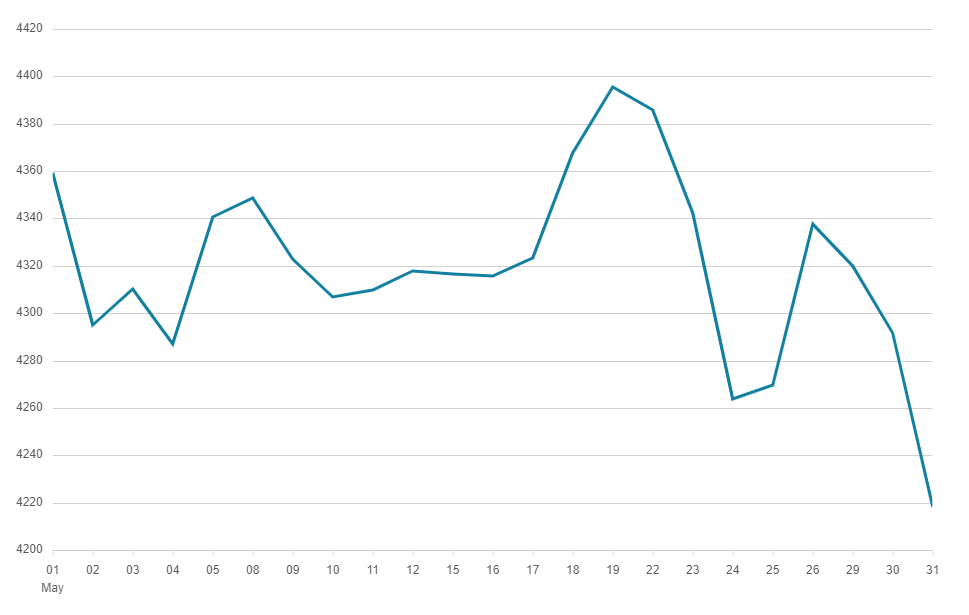

In European stock markets, the EuroStoxx 50 Index fell by over 3% in May, bringing the year-to-date performance close to +11%.

Source: BBC Market Data

Source: BBC Market Data

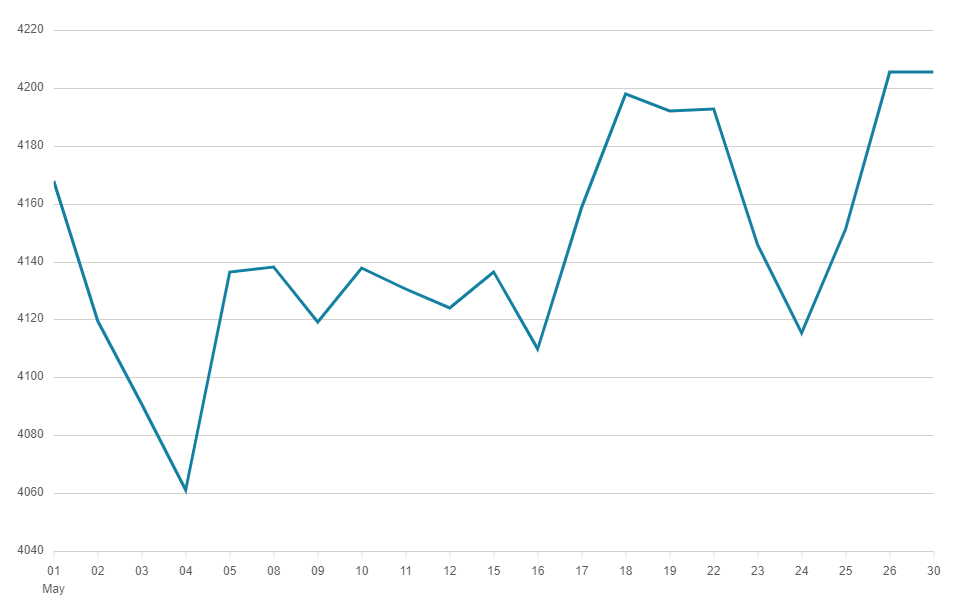

In US stock markets, the S&P 500 Index was unchanged in May, bringing the year-to-date performance close to +9%.

Source: BBC Market Data

Source: BBC Market Data

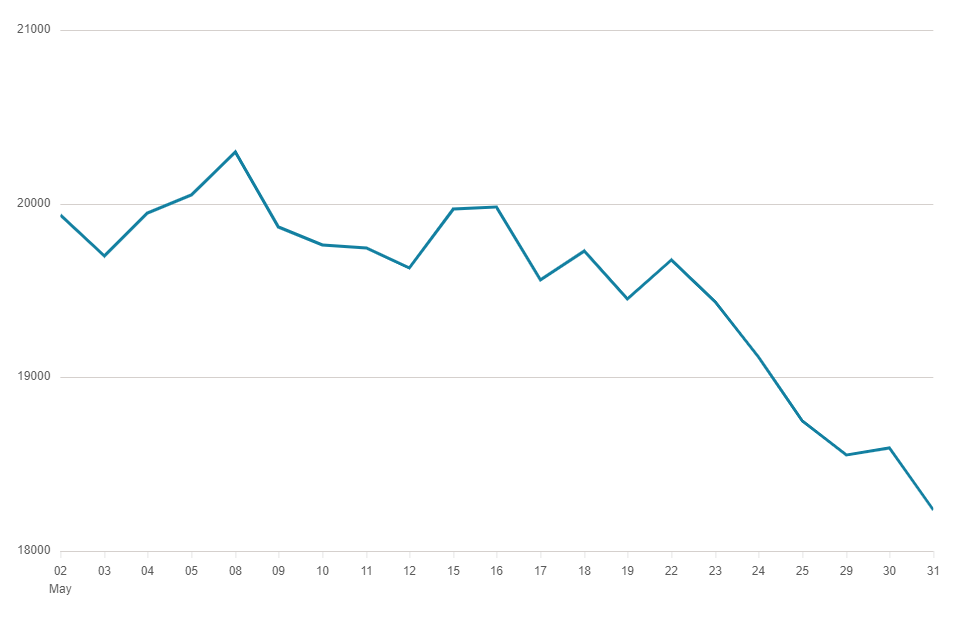

In Asian stock markets, the Hang Seng Index fell by over 8% in May, bringing the year-to-date performance close to -8%.

Source: BBC Market Data

Source: BBC Market Data

An investor’s guide to Artificial Intelligence

The Industrial Revolution had a far-reaching impact on society, as new inventions both demolished old jobs and built new industries. This era was transformative to the UK’s economic status, and today we’re seeing a second industrial revolution emerge due to the advancement of Artificial Intelligence (AI). From steam engines, to search engines - we’re now more reliant than ever on modern technology.

And how do pensions come into this? If you look at the top 10 holdings in your pension, you may find that you’re invested in many ‘Big Tech’ companies (such as Microsoft and Nvidia) that are exploring the capabilities of AI. Here’s our breakdown of how AI’s changing the global economy and what that could mean for your pension balance.

Rise in redundancies

The World Economic Forum recently published The Future of Jobs Report 2023, predicting that over the next five years 14 million jobs will be replaced by new technologies. In May, there’s been a wave of redundancies and future job losses making headlines. Telecoms giant Vodafone announced its plans to axe 11,000 jobs over three years. Simultaneously, competitor BT reported it’ll reduce its workforce by 55,000 across the next decade - with up to 20% of roles being replaced by AI.

As AI becomes more prevalent and powerful in the business world, the government’s role is to regulate this new industry. Last month the Prime Minister stated that “obviously there are benefits from artificial intelligence for growing our economy… with guardrails in place“ at the G7 summit in Japan. Consequently, he met the CEOs of Anthropic, Google’s DeepMind, and OpenAI in May, to develop safe and ethical regulation of AI technologies in the UK.

Boosting companies’ revenue

Founded back in 1971, the Nasdaq’s the world’s first electronic stock exchange and hosts the listings of many US technology companies. In April, ‘Big Tech’ company Microsoft published a 9% increase in profits from January to March, following an increased move towards AI usage for business functions. This trend was also reflected in other Nasdaq-listed companies, such as Apple and Tesla, which both reported strong earnings growth in Q1 2023.

One of the rising stars from this AI ‘gold rush’ was software company Nvidia. As an industry-leading supplier of AI products and technology, Nvidia made headlines in May as it briefly hit a market capitalisation of $1 trillion. However, even as the dust has settled, the company’s strong performance is undeniable. Nvidia’s share price rose by almost 31% in May alone, bringing the year-to-date performance close to +164%.

The increased adoption of AI solutions by businesses and consumers has boosted the demand for cloud computing, digital advertising and e-commerce services - which are the core offerings of these tech giants. As of writing, the Nasdaq-100 Index is performing at a 12-month high.

Summary

These examples show that AI’s not only a buzzword, but a powerful tool that’s shaping the global economy - from rising redundancies, to boosting company’s revenue. As an investor there’s plenty to be excited about with these new technological advancements. Many companies safely using AI software, alongside human intelligence, are widely predicted to deliver better long-term profits for investors - including pension savers.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in June 2023?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.