This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in March 2022?

It’s been an unexpected year and this has been reflected in the performance of the stock markets as they’ve responded to uncertainty and change. March gave us a glimmer of hope, but April has resumed a generally weaker economic outlook. So what’s happening?

The usual suspects have continued to impact markets, including: record breaking inflation, supply chain disruption, the effects of coronavirus, labour shortages, an uncertain interest rate trajectory, and the ongoing geopolitical crises. With income levels remaining the same, but everyday costs rising, essentials have become less affordable leading to a cost of living crisis. Less spending affects company profits, meaning investments dip in value. All pensions across the UK are likely to have experienced the impact of this macroeconomic uncertainty.

Fortunately, there’s a precedent of recovery following market falls and pensions are long-term investments. If the global economy grows over time (which historically it has), then your pension should also recover over time.

The current challenges affecting pensions

Let’s have a look at the current events impacting global investments - including pensions.

A big problem currently facing global economies and stock markets is supply chain issues. Russia’s invasion of Ukraine has created a complex list of problems. Countries including the UK have placed sanctions on Russia, which has weakened its economy. However, in retaliation Russia has threatened to stop supplying gas to Europe, which has contributed to rising fuel prices.

In Ukraine millions of people have been displaced and thousands of buildings destroyed, weakening the economy. Beyond their gas supplies and manufacturing, both countries are significant food producers. Together they’re a global supplier of 25% of wheat, 30% of barley, and 60% of sunflower oil. Consequently, the price of these goods has also risen as the effect of inflation is seen on household essentials like bread.

Elsewhere we’re seeing the impact of China’s latest shutdown as a result of rising coronavirus cases. Starting in Shanghai these restrictions have been extended to more regions. From iPhones to Tesla cars, many technology companies use China for their manufacturing. China accounts for nearly 30% of all global manufacturing and the shutdown of these regions has real consequences on businesses.

In summary, these global supply chain issues are directly contributing to a weaker outlook for households and businesses and have played a part in the rocky start to the year in stock markets. When you’re a PensionBee customer, your pension is managed by one of the world’s leading money managers: BlackRock, HSBC, Legal & General, or State Street Global Advisors. Each one of our money managers will design and adjust your investments to mitigate the impact of these challenges on your pension and keep your pension on track to continue growing in the long-term.

What happened to the markets in April?

April saw a sharper fall following the brief recovery stock markets made in March.

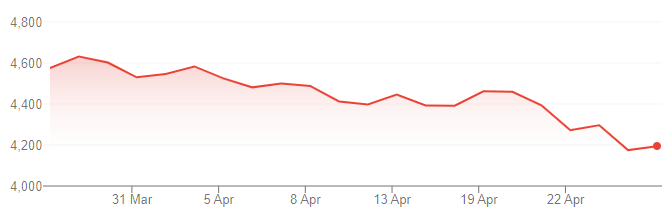

In the UK, the FTSE 250 fell by over 3%.

Source: Google

Source: Google

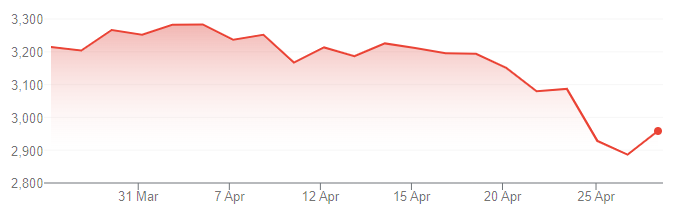

In the US, the S&P 500 fell by over 8%.

Source: Google

Source: Google

In China, the SSE Composite fell by nearly 8%.

Source: Google

Source: Google

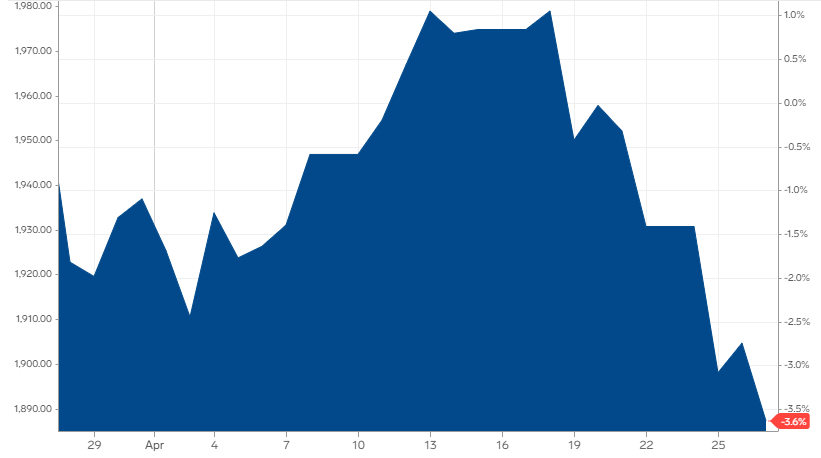

The price of gold fell less than 1%.

Source: Business Insider

Source: Business Insider

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in May 2022?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.