February was, in many ways, a continuation of January’s rocky start to the year. Stock markets continued to fall as a result of rising inflation, rising interest rates and a generally weaker economic outlook.

But Russia’s recent invasion of Ukraine has added another uncertain element to the mix, which has already disrupted global financial markets and could see pensions experience further volatility for some time.

The impact of Russia’s invasion of Ukraine

The unprovoked invasion of a democratic and sovereign European country sent shockwaves around the world.

Severe sanctions are being put on Russia by many western countries, greatly isolating it economically from much of the world. Ukraine’s economy has also been severely disrupted, as its people shift from a ‘thriving’ to ‘surviving’ mode of operation.

So what does this mean for your pension? There are direct and indirect consequences.

Direct consequences

The following could affect your pension’s investments directly:

- European and US stock markets fell in value, as investors began moving money towards lower-risk investments such as cash, bonds and gold.

- While more investments are made into cash and other lower-risk investments, high inflation will severely limit its real-term growth potential.

Indirect consequences

The following could affect your pension’s investments indirectly:

- The Russian stock market fell 30% the day it invaded Ukraine (it could have been more, had the Russian central bank not intervened), as investors rushed to sell their stocks ahead of potential sanctions.

- The cost of raw materials has increased (wheat prices are at a 13-year high - Russia and Ukraine account for 25% of global wheat production), impacting global production and further fuelling inflation.

- The cost of energy has increased (oil prices are at an 8-year high), impacting global production and further fuelling inflation.

All these factors ultimately have global implications, and financial institutions are well aware of the potential impact on their customers. PensionBee customers can rest assured that our plans’ money managers (some of the largest and most experienced in the world) are monitoring this very fluid situation closely.

The table below looks at the exact percentage of exposure by plan type.

| Plan Type | Exposure to Russian companies |

|---|---|

| Fossil Fuel Free | 0% |

| Shariah | 0% |

| Preserve | 0% |

| Pre-Annuity | 0% |

| Tracker | 0.1% |

| 4Plus | 0.2% |

| Tailored | 0.1% - 0.2% (depending on vintage) |

Source: State Street Global Advisors, Legal & General, HSBC and BlackRock

What happened to the markets in February?

February saw many global stock markets continue to fall as more investments were shifted into traditionally more stable assets such as gold and government bonds.

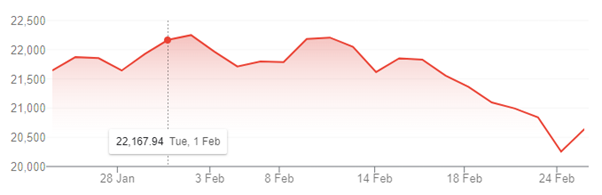

In the UK, the FTSE 250 had fallen by around 7% by 25 February.

Source: Google

Source: Google

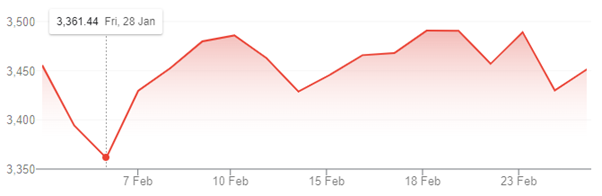

In the US, the S&P 500 had fallen by around 6%.

Source: Google

Source: Google

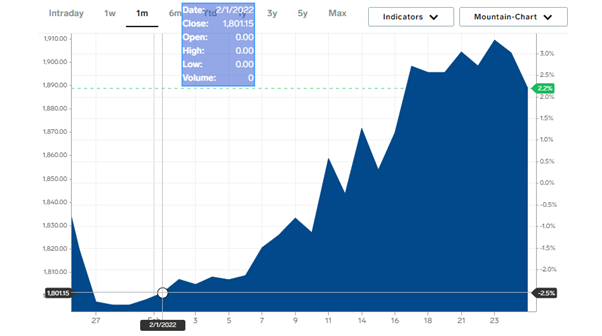

In China, the SSE Composite had risen by around 3%.

Source: Google

Source: Google

The price of gold had increased by around 5% by 25 February.

Source: Business Insider

Source: Business Insider

How is this impacting our plans?

Our Fossil Fuel Free, Shariah and Preserve Plans have no exposure to the Russian companies and our Tracker, 4Plus, Pre-Annuity and Tailored plans have minimal exposure to Russia - less than 0.4% to be precise, which is limiting the knock-on effects of economic sanctions imposed on Russia and Russian businesses to our pension plans.

However, our pension plans do continue to be impacted by the global stock markets’ turbulent start to the year.

If you’re in a higher risk plan

Customers in higher risk plans, like those further from retirement, may have pensions that are more exposed to the stock market. This helps maximise your pension’s growth potential while there’s still plenty of time to recover any short-term losses.

It also means that you’ll likely have seen your pension fall in value in February.

As we’ve mentioned, this is normal and expected behaviour. And we expect your pension to recover its losses and experience further growth in the future.

If you’re in a lower risk plan

Customers in lower risk plans, like those approaching retirement, may have pensions that are less exposed to the stock market, and more invested in lower-risk assets like gold and government bonds.

This doesn’t protect your pension against loss in value. But it does mean that any loss in value should be less severe than if it were more heavily invested in the stock market, like our plans for those further from retirement.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in March 2022?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via engagement@pensionbee.com.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.