This is part of our monthly pension update series. Catch up on last month’s summary here: What happened to pensions in May 2022?

Pension balances across the UK are still grappling with market volatility. And on the surface it may feel like your retirement savings hit the brakes and began reversing. We know that global investments have dropped in 2022 - but what are our investments (including our pensions) made up of?

Asset classes are ways of grouping investments: bonds, cash, companies shares, amongst others. Most investment products (like pensions) are diversified, meaning they contain a range of different asset classes to spread the level of risk and reward.

Company shares and bonds are often compared to the tortoise and the hare. Company shares are typically seen as faster growing investments at the risk of occasionally stalling, whereas bonds are usually considered to be a stable investment that plods along in line with inflation. In this current economic climate company shares are suffering, however more surprisingly bonds are too.

Keep reading to learn what bonds are and why they’re in decline this year.

What happened to the markets in June?

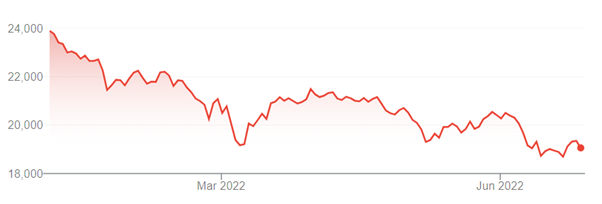

June began a sharper global market downturn as we officially entered into a ‘bear market‘.

In the US, the S&P 500 fell by a further 5% in June, bringing year to date losses to -20.33%.

Source: Google

In the UK, the FTSE 250 fell by a further 7% in June, bringing year to date losses to -20.27%.

Source: Google

As of writing, the S&P Global International Bond Index is reporting 23._higher_rate losses this year alone.

What are bonds?

Bonds are basically loans given by investors to companies. In exchange for their funding, the company usually pays investors fixed interest on the bond amount before repaying it in full. Bonds have different characteristics (like mortgages) from their interest rates to their term length.

There are two types of bonds: corporate and government. Corporate bonds are taxable investments, whereas government bonds are tax-exempt. On the other hand, corporate bonds usually pay investors a higher interest rate than government bonds.

Historically bonds have been seen as ‘safe assets‘. As such they’re often included in pensions to balance portfolios from the volatility of higher risk investments like company shares - especially for people approaching or in retirement.

How big is the bond decline?

Bonds thrive on market stability as they aim to provide moderate growth for investors. Recent surges in inflation and rising interest rates have pushed bonds between the proverbial rock and a hard place - leaving investors understandably concerned.

In 2022, the Scottish Widows Four Series Pension Fund, which is 58% bonds, dropped by over 12%.

Source: Morningstar

And the Aviva My Future Focus Annuity Pension, which is _rate bonds, dropped by over _corporation_tax_small_profits.

Source: Morningstar

While asset classes such as company shares are used to the ups and downs, bonds have been relatively sheltered from volatility until this point. To understand why this drop in bond prices is so surprising, all we need to do is look back at their last significant fall in value.

Bond performance of the past

This year, global government bonds are on track for an approximate annualised loss of 29%. The last time bonds were this bad, the UK’s monarch was Queen Victoria and US President Abraham Lincolm was succeeded by Andrew Johnson, and that was back in 1865. Since then bond markets have seen steady growth of approximately 5% each year, overtaking inflation by a slim margin.

The downside is obvious; bonds and investments that are bond-heavy have seen dramatic losses this year. The upside is that hopefully we’ll recover some or all of these falls in the medium term, and not see double digit losses for another two hundred years, give or take.

What should you do if you’re invested in bonds?

There are multiple ways in which your pension can grow over time, based on the type of assets in your pension plan. The growth of each asset depends on a number of factors which influence how much they grow in value. It might be tempting to switch to a different pension plan when you see your balance falter.

However, pensions are long-term investments and have historically weathered all short-term financial storms that have been thrown at them. It’s impossible to completely isolate your retirement savings from the wider economy - even investing in cash means you could lose value due to inflation.

It is also important to bear in mind that many pension funds will be diversified, including investments in bonds and shares. It is possible that shares will recover at a different pace, perhaps more quickly than bonds. Read our article on bear markets to learn more.

Key takeaways

- Market volatility is a widespread, international issue

- Switching plans or providers isn’t likely to change your situation

- Withdrawing large sums locks in your losses

As a general rule of thumb, when markets are down company shares become more affordable to investors. For example, if you buy company shares during a downward trend at £1 per share, then during a market recovery they increase to £1.50 you’ll have seen a 5_personal_allowance_rate increase on your initial investment. Of course, there is no guarantee that this will happen, but if you’re able to, then adding to your pension pot could allow you to effectively grow your pension in the long-term.

This is part of our monthly pension update series. Check out the next month’s summary here: What happened to pensions in July 2022?

Have a question? Get in touch!

You can check out our Plans page to learn how your money is invested in different assets and locations. You can always send comments and questions to our team via [email protected].

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Period | Market Event | FTSE World TR GBP (%) | 4Plus Plan (%) |

|---|---|---|---|

4Plus Plan’s inception – 6 Sept 2013 | QE Tapering, China Interbank Crisis and its aftermath | -5.44 | -2.41 |

3 Oct 2014 – 15 May 2015 | Oil price drop, Eurozone deflation fears & Greek election outcome | -5.87 | -1.77 |

7 Jan 2016 – 14 Mar 2016 | China’s currency policy turmoil, collapse in oil prices and weak US activity | -7.26 | -1.54 |

15 June 2016 – 30 June 2016 | BREXIT referendum | -2.05 | -1.07 |